Explain the Difference Between Debt and Equity Financing

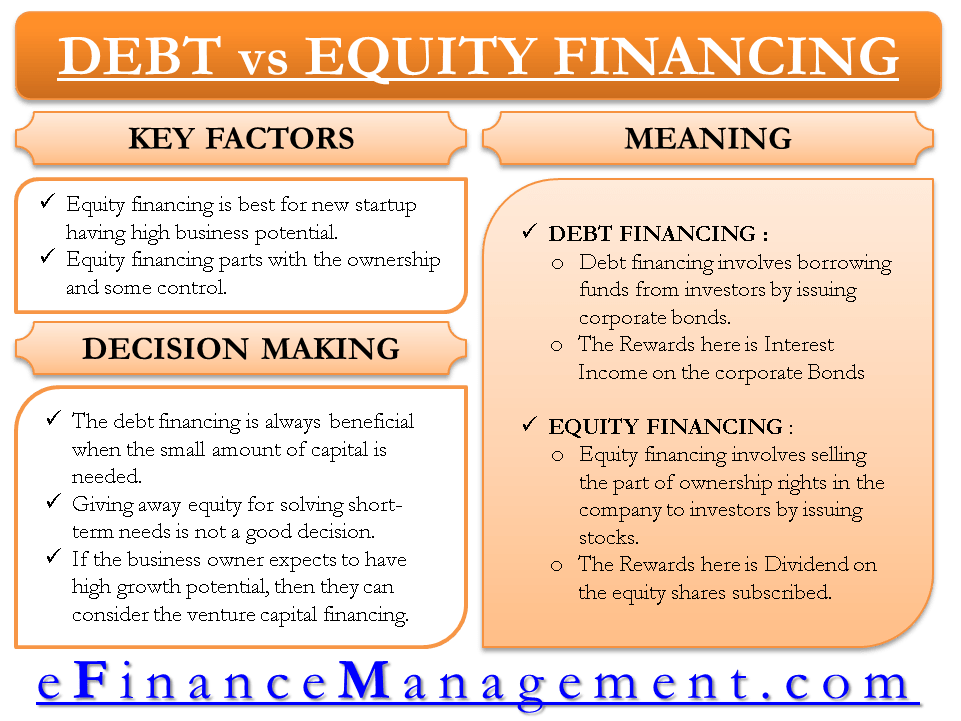

Debt involves borrowing money directly whereas equity means selling a stake in. High-growth businesses may want to go public in the future and they may seek venture capital.

Debt Vs Equity Difference Between Equity And Debt Fund

Equity financing is money paid to your business by an outside entity.

. In debt financing the company issues debt instruments such as bonds to raise money. Equity financing involves increasing the owners equity of a sole proprietorship or increasing the stockholders equity of a corporation to acquire an asset. Debt involves borrowing money to be repaid plus interest while equity involves raising money by selling interests in the company.

Essentially you will have to decide whether you want to pay back a loan or give shareholders stock in your company. You will have to weigh out debt vs. Debt financing involves the borrowing of money whereas equity financing involves selling a portion of equity in the company.

Equity financing involves the owner giving up a share of the business. Debt financing is borrowing money from a lender in exchange for interest payments. The primary difference between debt and equity financing is the type of instrument the company issues in order to raise the capital it needs.

Debt and equity financing are two very different ways of financing your business. The funds come from an investor not a lender. With equity you again have no.

Debt financing may have more long-term financial benefits than equity financing. Make sure youre aware of the differences between debt vs. Debt and Equity Funding are considered two different categories of financing resources for business owners who demand capital to expand.

Equity is a convenient funding method for businesses that do not have collateral. Get Free Quotes From USAs Best Lenders. Debt and equity are both forms of finance that provide funding for businesses and avenues for obtaining such finance usually stem through external sources.

Equity financing is borrowing money from a lender in exchange for equity. With equity financing a company raises capital by issuing stock. A home equity loan if the business owner owns a property is available too but is a.

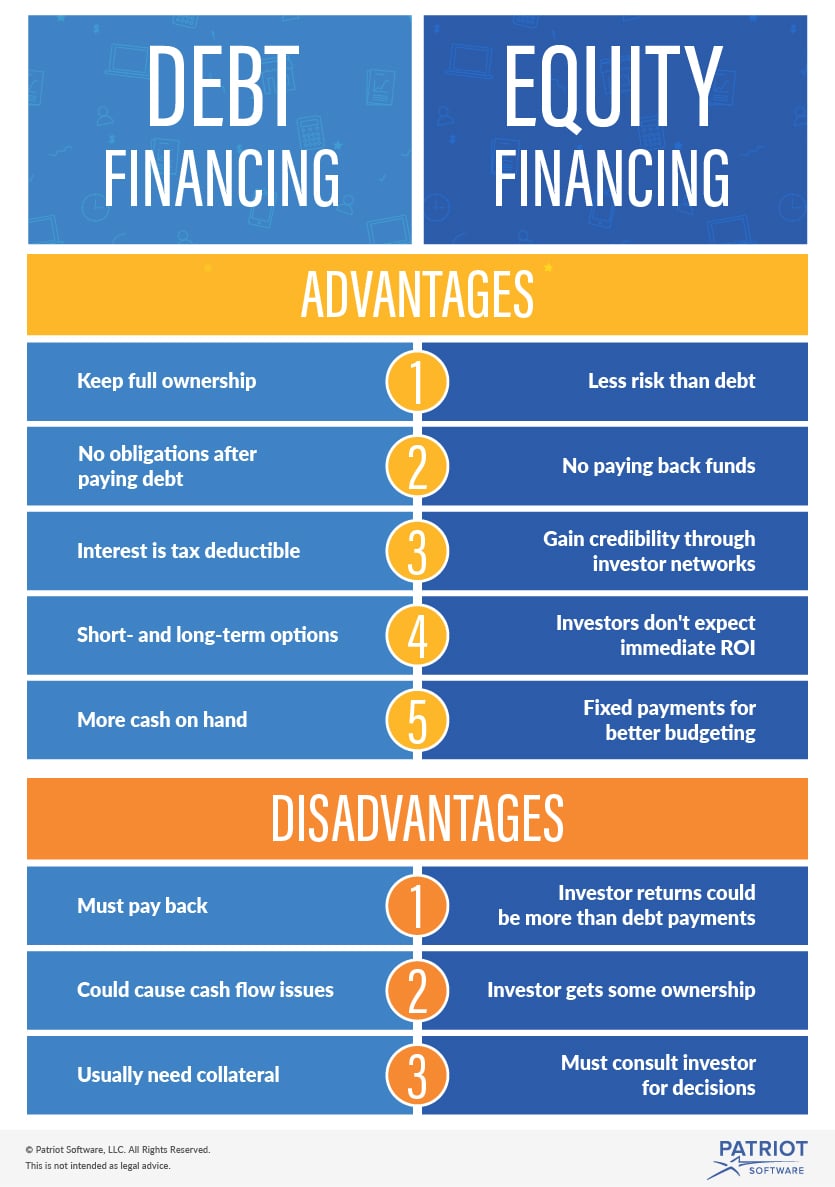

You will probably need to offer business collateral. Debt always involves some form of repayment with interest that must be made whether the company is making a profit or not. A really interested investor might give enough money to not only launch your business but to fund years of operation and even additional product development.

Equity advantages and disadvantages. Hence unlike debt financing which presents a pre-determined cost equity financing has a more variable cost because its a stake in the future value and earnings of your business. Equity shareholders receive a dividend on the companys profits but it is not mandatory.

Compare Get The Lowest Rates. What is equity financing. With equity financing you do not have to make repayments or pay interest.

Debt financing could cause small business cash flow problems. Debt holders receive a predetermined interest rate along with the principal amount. Unlike debt equity financing doesnt require repayment.

Debt Finance There are multiple options to secure debt finance for example self-funding a business loan a personal loan a loan from family or friends debt-based crowdfunding. The main advantage of. The providers of equity financing are known as shareholders whereas providers of debt financing are known as debenture holders bondholders lenders and investors.

Two main sources of external income include business debt financing or financing from equity investors. Ownership When equity investors purchase a share in your company your own shareholding would reduce but with debt financing you retain 100 ownership. Debt has the advantages of not compromising future profits of.

When a corporation issues additional shares of common stock the number of issued and outstanding shares will increase. Debt Funding involves borrowing money from a legal institution such as a bank as long as agreeing to pay some interest which is basically the price of money. Debt is a cheap financing source since it saves on taxes.

Equity financing so that you can make an educated decision. Ad Apply Online For a Home Equity Loan. Debt financing has a limit depending on your credit and how much youre able to repay but equity financing is limited only by how much your investor is willing to give you.

With debt financing you would still have the same 4000 of interest to pay so you would be left with only 1000 of profit 5000 - 4000. The Search For The Best Home Equity Loan Ends Today. All theyll need in return is partial.

The following table discusses the advantages and disadvantages of debt financing as compared to equity. With equity financing investors will be entitled to profits and if. Definition of Equity Financing.

This increase will cause the previous stockholders ownership percentage.

Debt Financing Vs Equity Financing What S The Difference

0 Response to "Explain the Difference Between Debt and Equity Financing"

Post a Comment